nj property tax relief for seniors

Rising inflation could result in senior and disabled homeowners to qualify for a higher property tax rebate from New Jersey. To be eligible you or your spouse or civil union partner must have been 65 or older on Dec.

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

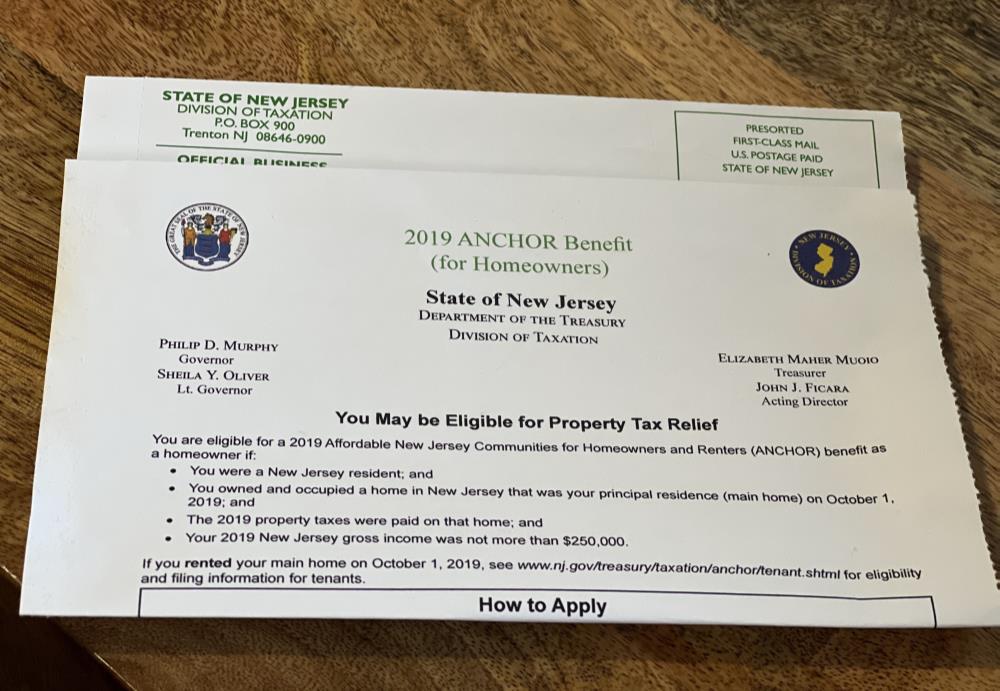

The deadline for filing your ANCHOR benefit application is December 30 2022.

. The state of New Jersey provides senior citizens and people with disabilities with some relief regarding property taxes. Alternate documents to send as proof can be found. The verification form is your proof of property taxes due and paid.

And while the state this year has rolled out an altogether. If you qualify and have not received this application call 1-800-882-6597. We will begin paying ANCHOR benefits in the late Spring of 2023.

Average bill more than 9000. This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and met the income limits. Property taxes in the state are generally high which is especially hard for senior citizens who live on a fixed income.

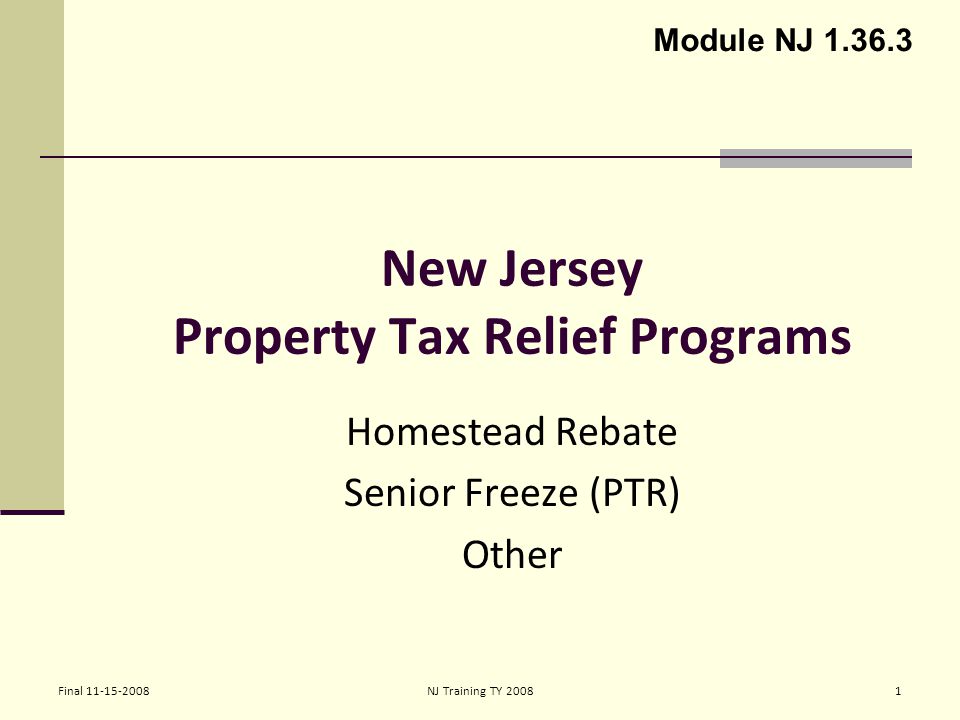

This property tax relief program does not actually freeze your taxes but will reimburse you for any property tax increases you have once youre in the program. It was founded in 2000 and has since become a participant in the American. Finally there is a Property Tax DeductionCredit to homeowners of either up to 15000 of property taxes paid or a 50 refundable credit refundable meaning that even if.

However the deadline to apply for the Senior. If you are age 65 or older or disabled and have been a New Jersey resident for at least one year you may be eligible for an annual 250 property tax deduction. This program provides property tax relief to New Jersey residents who owned or rented their principal residence main home on October 1 2019 and met the income limits.

And for the senior-freeze program Treasury officials have estimated the FY2022 budget will fund. 75000 or less for homeowners under the age of 65 and not blind or disabled. The program will then freeze property tax increases for subsequent years.

If you meet certain requirements you may have the right. NJ property taxes climbed again in 2020. 150000 or less for homeowners aged 65 or over blind or disabled.

ANCHOR payments will be paid. The 2020 property taxes due on your home must have been paid by June 1 2021 and the 2021 property taxes must be paid by June 1 2022. If you meet certain requirements you may have the right to claim a.

The Senior Freeze Program reimburses eligible senior citizens and disabled persons for property tax or mobile home park site fee increases on their principal residence. Property Taxes Site Fees. Meet the income requirements.

More Issues For those living on a fixed income it can make all the difference Muoio said in a recent news release. About the Company Property Tax Relief For Nj Seniors CuraDebt is a debt relief company from Hollywood Florida. If you purchase a product or register for an account.

The state of New Jersey provides senior citizens and people with disabilities with some relief regarding property taxes.

2021 Property Tax Relief Application Senior Freeze Now Available Borough News Borough Of Glen Rock New Jersey

How Can You Lower Your Property Taxes In Nj Askin Hooker Llc

Property Tax Rebates Recoveries Ptr Homestead Benefit Ppt Download

Middle Reminds Eligible Residents To Apply For Tax Relief Middle Township New Jersey

Apply For Historic Property Tax Relief Program City Of Perth Amboy

Murphy Announces Details Of Property Tax Relief Program Whyy

Corrado Update On Senior Freeze Benefits And Homestead Benefit Programs Senatenj Com

Governor Phil Murphy On Twitter With Our New Anchor Property Tax Relief Program We Will Distribute 900 Million To Nearly 1 8 Million Homeowners And Renters Across New Jersey Helping Families And

New Property Tax Relief Program Would Assist 1 8m Nj Homeowners Renters Njbiz

Nj Division Of Taxation Senior Freeze Property Tax Reimbursement Program 2017 Eligibility Requirements

Anchor Tax Relief For Homeowners Renters Nj Spotlight News

Nj Anchor Property Tax Relief Program Replaces Homestead Benefit Middlesex Borough

Department Of The Treasury Senior Freeze 2022 Toolkit

Nj Division Of Taxation Nj Division Of Taxation Senior Freeze Property Tax Reimbursement

Tax Collector S Office City Of Englewood Nj

Property Tax Relief I Ve Got A Proposition For You Governor Mulshine Nj Com

Some Taxpayers Could Get Rebates Quicker Under New Bill Across New Jersey Nj Patch

Final Nj Training Ty New Jersey Property Tax Relief Programs Homestead Rebate Senior Freeze Ptr Other Module Nj Ppt Download

How To Get Property Tax Relief Senior Freeze Deadline November 2 South Brunswick Nj News Tapinto